Take Control of Your Investments

Unleash the Power of AI: Navigate News, Data, and Technicals for Smarter Retail Investing!

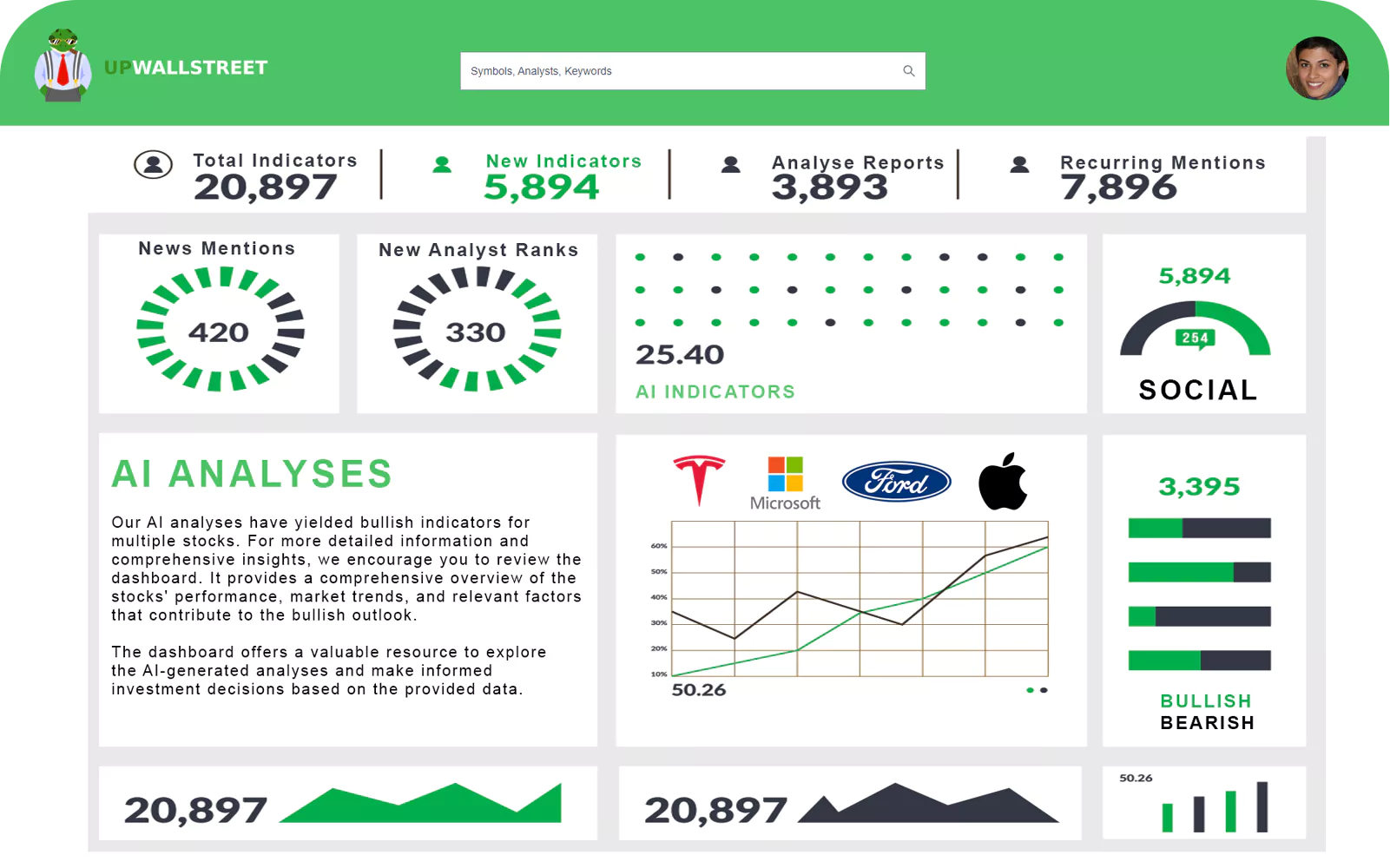

AI-Driven Web Analysis for Informed Decision-Making

Make Better Investment Decisions with Accurate and Actionable Insights from our Cutting-Edge AI Technology

Sentiment Analysis

AI-driven web analysis can assess the sentiment surrounding investment-related news, social media discussions, and expert opinions. By understanding the overall sentiment, investors can gauge market sentiment and make informed decisions based on the prevailing sentiment.

News Analysis

AI algorithms can analyze a vast amount of news articles, blog posts, and press releases to identify key market trends, significant events, and breaking news that may impact specific investments. This helps investors stay updated with the latest information and react promptly to market developments.

Financial Data Analysis

AI-driven web analysis can extract and analyze financial data from various sources, including company reports, financial statements, and market data. By leveraging this data, investors can evaluate the financial health, performance, and growth potential of companies and sectors, assisting them in making more informed investment decisions.

Technical Analysis

AI algorithms can analyze technical indicators, charts, and historical price data to identify patterns, trends, and potential price movements. By examining various technical aspects, investors can gain insights into potential entry and exit points, support and resistance levels, and other relevant factors that aid in making well-informed investment decisions.

“Artificial intelligence is the future of investment analysis, unlocking new realms of data and insights to empower investors like never before.”

— Peter McPau, Founder and CEO, Active

3.5M

— Active users

50k

— Brands

250K

— Accounts Managed

30M

— Active leads

Research Investments

Research all companies in just one place.

Efficiently analyze vast amounts of data, identify patterns, and provide actionable insights. AI-powered tools can help investors conduct in-depth company research by extracting relevant information from financial statements, news articles, and other sources.

Reporting Metrics

Advanced analytics, easy to understand.

Power reports

Our website provides access to cutting-edge research and analytic tools powered by AI. With these advanced tools, investors can gain valuable insights and make data-driven decisions with confidence.

AI Power reports

Our AI reports offer in-depth analysis of financial markets, company performance, and industry trends, helping investors stay informed and ahead of the curve.

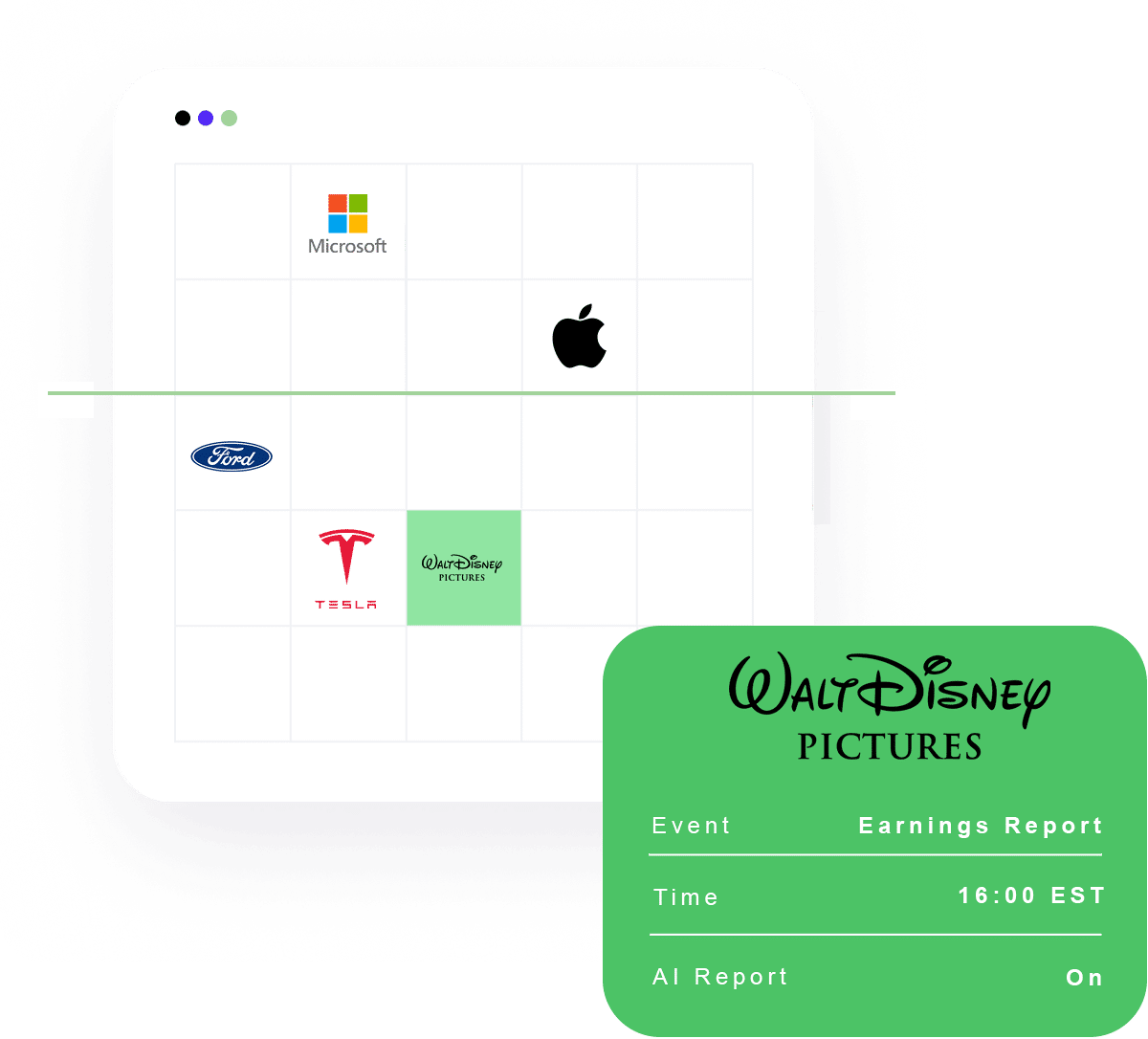

Improve Scheduling

Powerful AI Reports Future Key Events

Key information about your watchlist and economic events. Our AI technology is equipped with knowledge of significant upcoming events that could significantly impact the companies you're studying.

Integrations

Integrated with the tools you know and love

Our AI Technology is integrated with the best sources of information and analyses, our learning tools improve every day with the fast changing investment world.

Pricing for Everyone

We don't ask much but your support is welcome to make our tool more powerfull for you in the future!

Monthly

Yearly

Hike Plan

Free

Try the Power of AI Tools and Analyses.

What's included

- See an overview of the Power AI

- View Random Stocks

SOON AVAILABLE

Jet Figher Plan

USD $20/month

Billed Yearly

What's included

- Nasdaq & NYSE Stocks

- 30 Stock Researchs per Month

- Daily Updates on 30 Stocks

- 10 Watchlists

SOON AVAILABLE

Astronaut Plan

Lets talk and see whats possible

What's included

- Everything in the Pay Plan

- Insights in Tests

- Custom Requests Per Month

- More...

SOON AVAILABLE

Frequently asked questions

For any other questions feel free to contact us.

AI plays a crucial role in investment analysis by leveraging advanced algorithms and machine learning techniques to analyze vast amounts of data. It can uncover patterns, trends, and correlations that may not be easily identifiable by humans alone. AI assists in tasks such as portfolio optimization, risk assessment, and predictive modeling, ultimately enhancing the accuracy and efficiency of investment decision-making.

AI improves investment decision-making processes by augmenting human capabilities with its ability to process and analyze large volumes of data at high speed. It can quickly analyze financial statements, news articles, market data, and social media sentiment to provide insights and recommendations. By automating repetitive tasks and detecting patterns in historical data, AI can help investors make more informed decisions, identify emerging opportunities, and mitigate risks.

AI utilizes various types of data for investment analysis. This can include financial statements, market data, economic indicators, news articles, social media sentiment, and alternative data sources such as satellite imagery or sensor data. The combination of structured and unstructured data allows AI models to extract valuable insights and generate predictions or recommendations for investment strategies.

The main benefits of using AI in investment analysis include enhanced data processing capabilities, improved speed and efficiency, increased accuracy, and the ability to uncover hidden patterns and trends. AI can also reduce human bias in decision-making and provide real-time monitoring of investment portfolios. However, there are potential risks, such as model inaccuracies, overreliance on historical data, and vulnerabilities to cyber threats or data breaches. It is crucial to carefully validate and monitor AI models and ensure proper risk management practices are in place.

AI-based investment analysis has shown promise in terms of accuracy and performance compared to traditional methods. By leveraging advanced algorithms and machine learning, AI can process and analyze vast amounts of data quickly and objectively. This can lead to more accurate predictions, better risk assessment, and improved portfolio optimization. However, it is important to note that AI is not infallible and should be used in conjunction with human judgment and expertise. Human oversight is essential to validate AI-generated insights and consider factors beyond the scope of data analysis, such as market dynamics and geopolitical events.